"This campaign has been live for a week, why are we not seeing that awesome performance yet?!? Are we doing the right thing?" I wish this were an exaggeration, but we've all heard this quick judgment before from a decision maker.

To think that the campaign you spent months planning and toiling over will magically make all invested parties happy is ambitious. There will always be extenuating circumstances popping up requiring a media strategy shift, and likely a senior leader within or above the client team will be ready to scrap the whole thing at the first sight of disappointment.

It's easy to always lead with the phrase, "just trust us on this," but we know the importance of supporting planning and strategy with data and hard facts.

Client Case Study

We were working with a CPG client whose overall sales had declined year-over-year prior to working with us. Due to the continual downturn in performance, the company's CEO had started to question the marketing team on the effectiveness of their efforts and was leaning towards slashing and reallocating the budget. This is where we stepped in.

In order for us to support the client team effectively, the question we needed to answer became clear: How can the current limited media budget be adjusted to grow sales and prove the value of marketing efforts?

Media Strategy Shift: Focus on What Matters

Instead of targeting across the board for this global brand, we segmented the known markets into two groups:

- Big Markets: States where the brand’s products have more than 30% shelf space at supermarkets

- Small Markets: States where the brand’s products have less than 30% shelf space at supermarkets

With a limited media budget, the marketing agency decided to focus on what mattered more - the big markets.

From Media to Analytics:

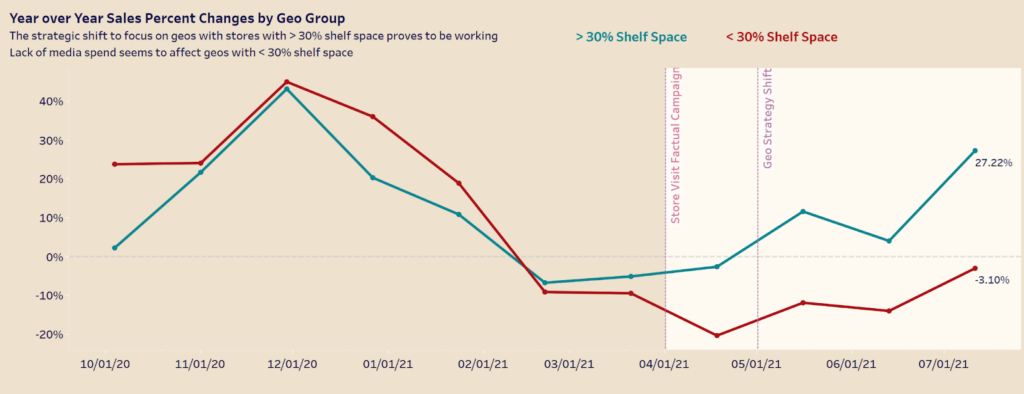

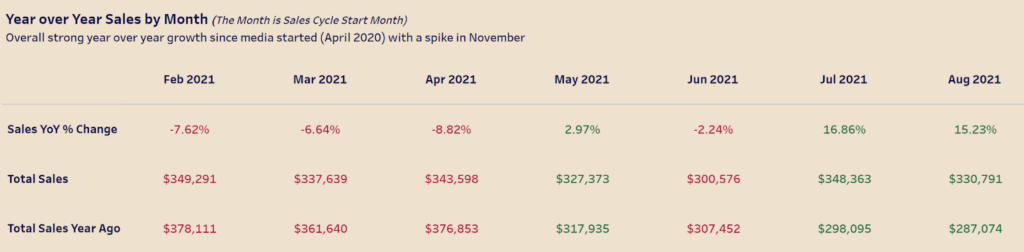

- Before alignment on targeting geographies, sales trends were quite similar between the big markets and small markets. In fact, small markets’ sales growth was consistently higher than big markets by a small margin

- Right after the first foot traffic-driving campaign and before the geography targeting shift, we started seeing a significant difference between year-over-year sales of the two groups

Within the first month since the geo targeting shift, we started seeing a positive sales trend year-over-year for big markets. The gap in year-over-year growth for big markets vs. small markets continued to widen.

- Overall sales saw impressive improvement for the next three months after the media strategy shift, with a double digit year-over-year growth

The focus-on-what-matters strategy worked, not only improving sales for the focused markets, but also sales overall.

It's always good to question your media strategy and performance. Having the right analytics team by your side is going to help you address each need when a shift in strategy is not only necessary for sound campaigns in the short term, but essential to sustained long-term success.