The Healthcare Industry and COVID-19

There is no doubt that the current reality of COVID-19 and its restrictions have caused many businesses within multiple industries to shift their operations to strictly digital. But how exactly is this affecting their marketing campaigns?

At RADaR, we work with clients in various industries, and each industry has been affected differently. Here we will analyze how one of our Healthcare client's campaigns have been affected during this pandemic. This is a Year over Year analysis in which we compare data from Jan 2019 vs. Jan 2020, Feb 2019 vs. Feb 2020, and March 2019 vs. March 2020.

Year Over Year Variance in Website Performance

With higher traffic, it is expected to see the website performance metrics to get worse as a larger portion of the new traffic tends to be composed of unqualified people. However, it was observed that the average performance for Display platforms remained consistent. On Paid Search it is important to highlight that even with a Bounce Rate for Paid Search almost two times higher in 2020 the net number of people who haven't bounced was three times higher on Q1 of 2020 in comparison to the same period of 2019.

Media Performance

In the first three months of 2020, the Display and Paid Search platforms have driven on average three (Display) and six (Paid Search) times more people to the healthcare provider's website, and it is important to highlight that the result was achieved with a budget 49% (Display) and 43% (Paid Search) lower in 2020. Meanwhile Social platforms, even with a budget for Q1 29% higher in 2020 have driven on average 84% fewer people to the website during the same time.

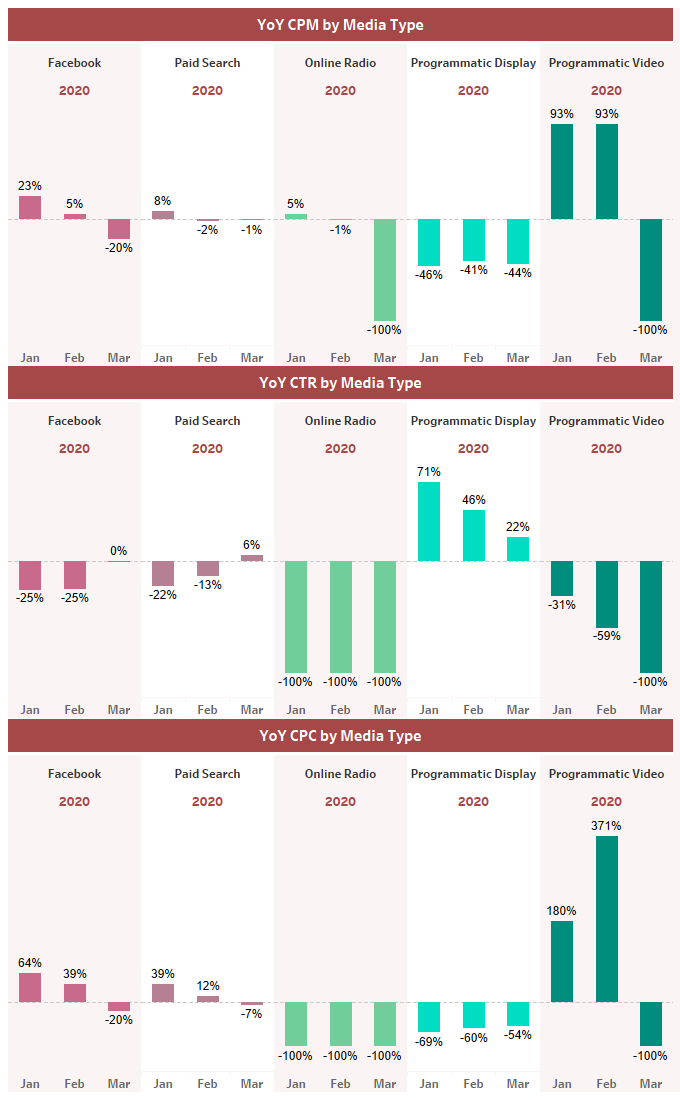

The Online Radio and Programmatic Video performance were so low on the first two months of 2020 that in March all the budget for Online Radio and Programmatic video was moved to Display, who saw all its performance metrics improve on Q1 of 2020 (CPC 60% lower, CPM 44% lower and CTR 43% higher) vs. Q1 of 2019.

Facebook, who was the biggest contributor to the poor site performance from social sources is showing signs of recovery. After averaging a CPM 14% and a CPC 51% higher in the first two months of 2020 (in comparison to the same period of 2019), it saw in March an improvement vs. 2019 with a CPM and a CPC 20% lower.

Our RADaR team will review these results at the end of this month to see which trends will be sticking around for a while. If you have any questions or would like further information on our findings, please contact us.