The Finance Industry and COVID-19

There is no doubt that the current reality of COVID-19 and its restrictions have caused many businesses within multiple industries to shift their operations to strictly digital. But how exactly is this affecting their marketing campaigns?

At RADaR, we work with clients in various industries, and each industry has been affected differently. Here we will compare data from March 2019 to March 2020 from a Finance client.

Year Over Year Variance in Website Performance

In the first three months of 2020, the Display platforms have driven on average 58% fewer people to the website. Meanwhile Paid Search and Social platforms have driven respectively 71% and 100% more people to the website at the same time. The highlights here go to the Social platforms (more specifically to Facebook), that in March (when the efforts to contain the pandemic have intensified) increased the website traffic by more than 142%.

With higher traffic, it is expected to see the website performance metrics to get worse as a larger portion of the new traffic tends to be composed of unqualified people. However, we observed the completely opposite, with a better average Bounce Rate, Session Duration, and Page Views for Social and Paid Search, and worse for Display.

Media Performance

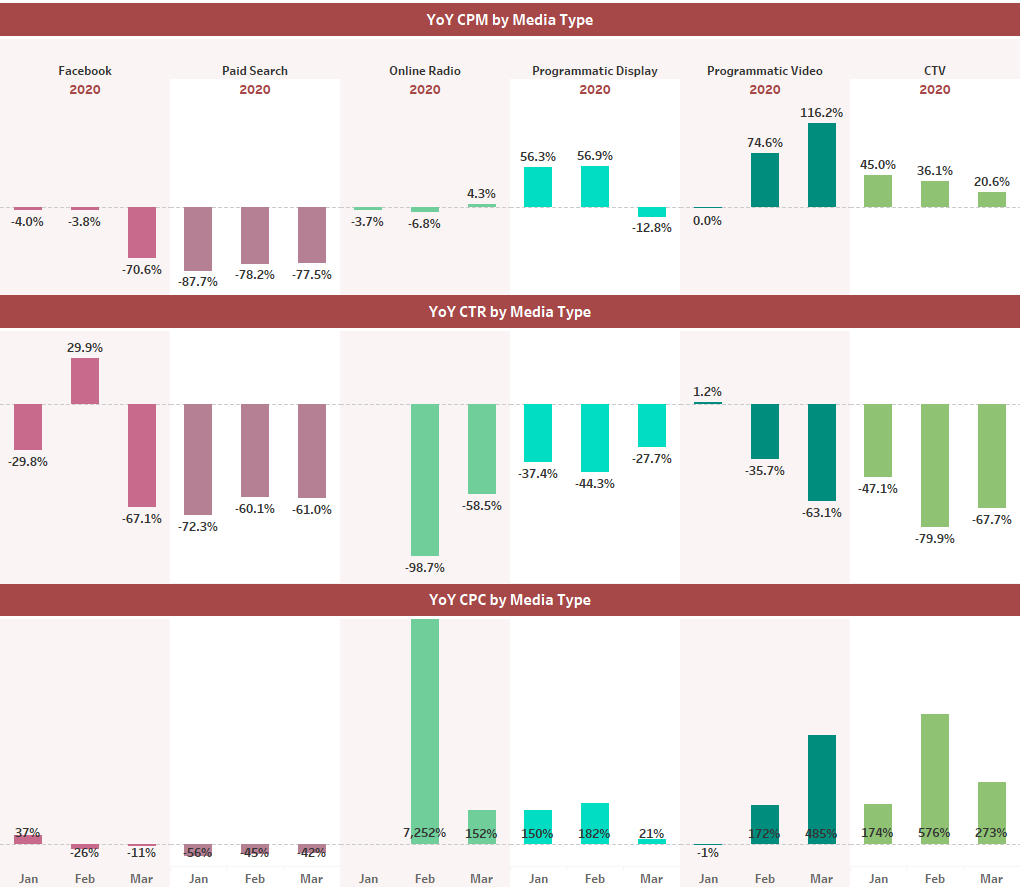

By separating each media type that integrates display, it is possible to understand the reasons behind the lower Display performance on driving traffic to the website. Programmatic Display, that is responsible for driving most of the website traffic, displayed an average CTR 36% lower in 2020 in comparison to 2019, and a higher cost (CPC 117% and CPM 33%) even with a budget similar to 2019. Comparing the Display video tactics it becomes evident how Connected TV, even though still more expensive, is becoming a cheaper option for awareness, but not as much for engagement, with a CPC almost three times higher in March 2020 in comparison to the previous month and 273% higher in comparison to March of 2019. Programmatic Video saw its CTR, CPC and CPM performance decline drastically in 2020, specifically in March, after social distancing started to be implemented in the US.

On the other side of the spectrum, Google Ads experienced an average CPC 47% and CPM 81% lower in 2020 compared to 2019, and even with a 64% lower CTR it was able to drive 71% more people to the website in 2020.

Facebook seems to be the platform that benefited most from the social distancing imposed to minimize the spread of COVID-19, with a drastic change on the CPM trend that dropped by almost 60% in March of 2020 in comparison to the previous month and by more than 70% in comparison to the same period in 2019, and even with a lower CTR was able to raise the website social traffic by 142%.

While the current state of our environment may deter companies from investing in their marketing campaigns, this is not a time to sit on the sidelines and wait it out. This is the time to gather data and analyze what is working and what isn’t in order to redirect your efforts to drive successful marketing outcomes.

Our RADaR team will review these results at the end of this month to see which trends will be sticking around for a while. If you have any questions or would like further information on our findings, please contact us.