COVID-19 Effect on Private Airlines

The impact of COVID-19 on the private flight sector greatly resembled that of the commercial airlines at the beginning of the pandemic. In April, private jet traffic was drastically down compared to the previous year. Skylark agency reported that the overall decline in the market was between 75-90 percent. In contrast, JetSuite reported a 20 percent surge in new broker requests the second week of March. The drastic difference in behavior could've been a result of impending lockdowns and travel bans, however, it could be an indication of what early air travel will look like as things return to normal.

Private Jet Card Comparisons conducted a survey in March of 2020 about people's intent on traveling after COVID-19. According to their insights, 33 percent of respondents still expected private flying to increase in 2020 and 30 percent expected the demand to remain flat.

With this in mind, we conducted our own analysis of the expected consumer behavior. Below are our results.

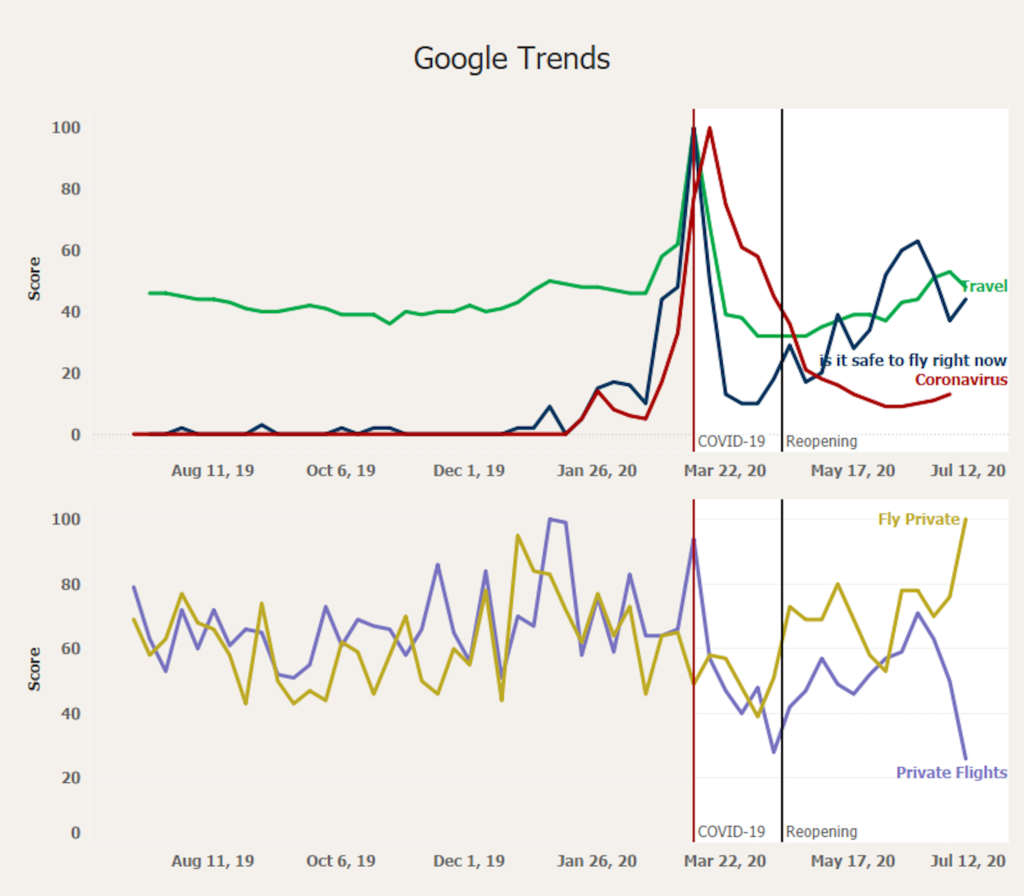

After President Trump announced states were allowed to reopen on April 16, 2020, there was a surge of people looking for information about the safety of traveling, as well as private flight availability. However, after that date, people started considering flying private at least as much as they were before compared to commercial flights, which continued to see low interest online.

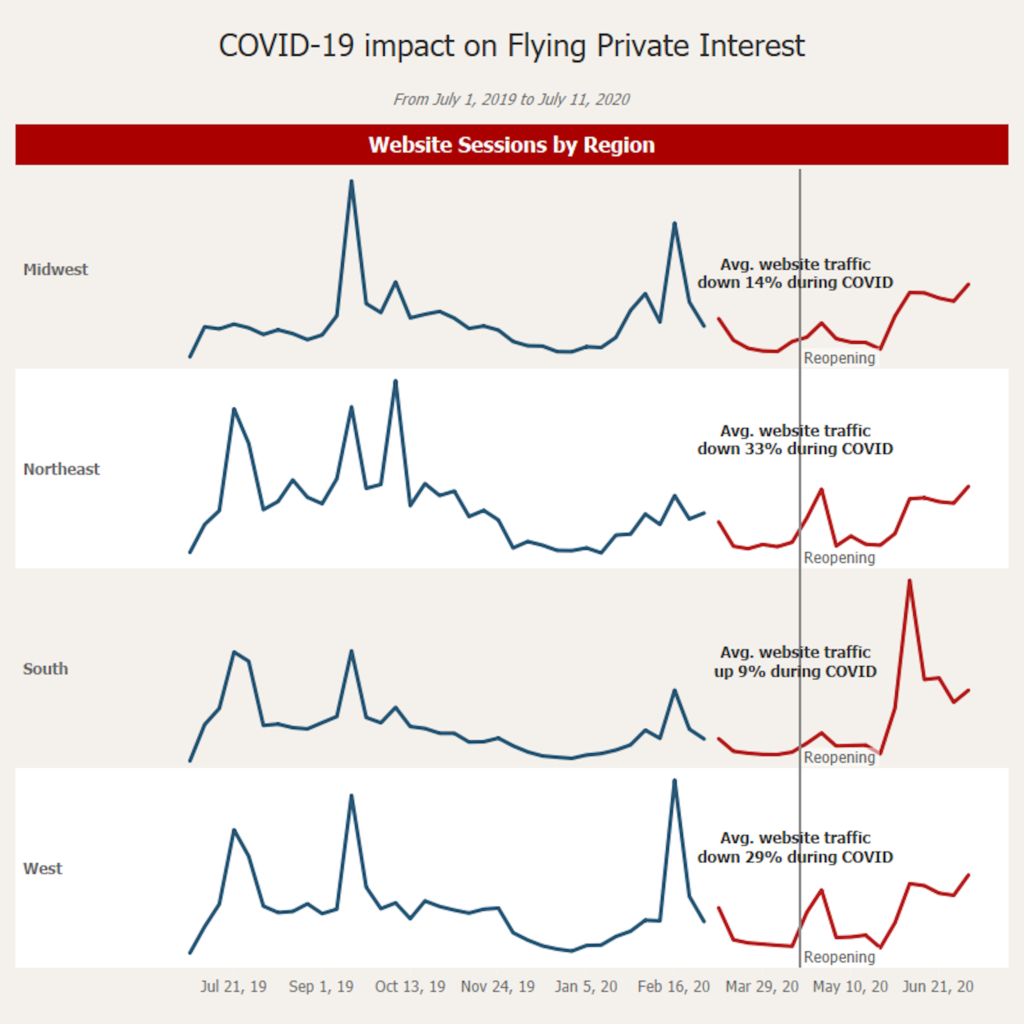

Through analyzing the website traffic from companies that offer private flights we were able to see the same spike in website traffic on April 16, 2020.

Breaking down the data by region allowed us to analyze how each part of the U.S. reacted not only to the pandemic but also to the news of states reopening. All states displayed a positive reaction towards flying private to the news of states reopening, with a special highlight to the South of the U.S., which was the only region with website sessions higher during the pandemic compared to before March 8, 2020.

If you would like to learn more about our customizable dashboards and solutions, contact us.